Why am I taxed on my monthly invoice?

Depending on the location of your business, you may be charged a Value Added Tax (VAT) on your monthly invoice.

If your business is based in the UK, there will be a standard 20% VAT added to your campaign spend. You can reclaim this tax at the end of the year by adding a VAT number upon signing up.

If your business is based in the European Union, but not part of the United Kingdom, you can prevent being taxed by adding in a VAT number when creating your first campaign.

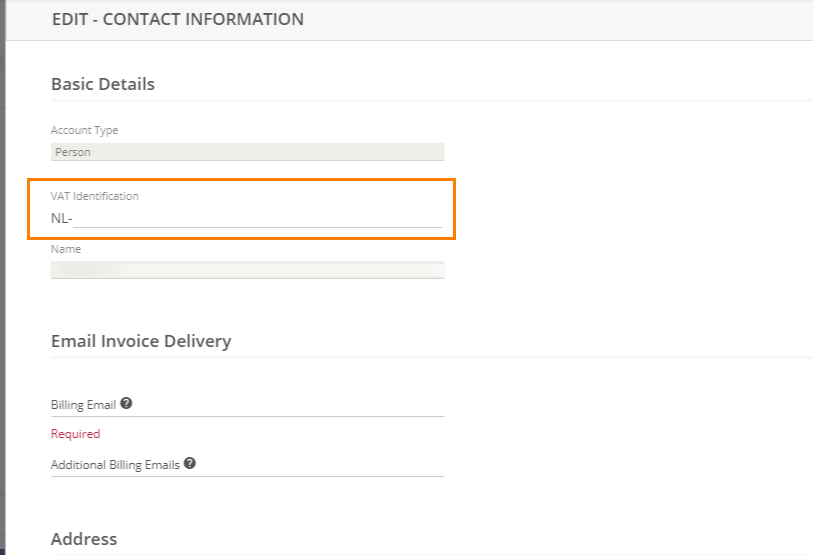

To add or update a VAT number, simply edit the Contact Information on the Payments tab.

Important to Note

- Not entering a VAT number means that you will be charged the standard rate of your billing country.

- For security reasons, your VAT number must be based in the same country that your billing address is located in.

- Any VAT changes will be reflected only on your future invoices.

If you have any questions, feel free to reach out to the DIY Customer Success team.

Was this article helpful?

YesNo