Playing for Profits: Affiliate Marketing in the Financial Services Industry

In recent years, there has been explosive growth of disruptive fintech and financial services apps.

Now you can find apps to help with everything from checking your account balances and setting up household budgets to more tailored financial advice and managing investments.

This shift offers a great opportunity for affiliate marketers in the finance space to make a good living.

In this guide, we’ll explore how you can tap into this trend and make your mark in the world of financial affiliate marketing.

Understanding Affiliate Marketing in Financial Services

In basic terms, affiliate marketing is promoting other people’s products or services through your own content and ads.

In the financial services industry, affiliates focus on referring people to products such as credit cards, loans, insurance, or investment platforms.

When it’s done well, everyone’s a winner with affiliate marketing.

- Affiliate marketers earn a commission for every client they bring on board or sale they get.

- Affiliate partners expand their client base and/or boost sales.

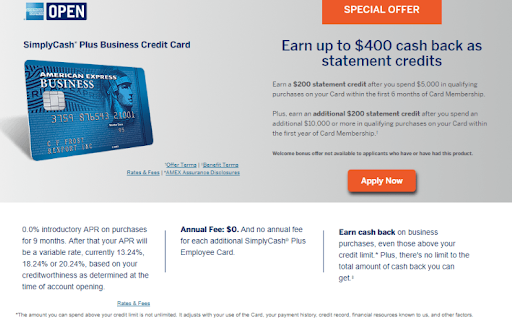

Credit card affiliate programs are a classic example of this win-win situation. Personal finance bloggers or YouTubers partner with banks to promote their credit cards. The marketer provides reviews, comparisons, and links, which all drive traffic to landing pages for credit card applications. The affiliate partner pays a set amount of money for each approved application that comes from one of the affiliate referral links.

When choosing affiliate marketers to work with, financial companies often look for people with a credible online presence and track record of producing quality, relevant content.

Affiliate marketing is a popular strategy with fintech startups, as it improves their chances of gaining traction in the marketplace. Partnering with established financial bloggers and influencers gives them a head start, as they’re able to reach highly targeted audiences more easily.

The Challenges of Affiliate Partnerships in Finance

While affiliate marketing in financial services can be a goldmine, it is also full of landmines. The finance industry is a sensitive one, involving highly regulated products and services, and a lot of vulnerable personal and financial data. Let’s take a look at some of the key challenges that affiliate marketers in financial services must overcome to win.

Finance Affiliate Marketing Challenges

Challenge 1 – Complying with regulations

Financial services is one of the most heavily regulated industries, which means extra care is needed for affiliate marketers.

Let’s say you’re promoting a personal loan product. Regulation is strict, so you’ll need to pay careful attention to:

- Transparent fee disclosure: Clearly state interest rates and any additional fees. This info must be accurate and clarify the financial commitment involved.

- Risk disclosure: Include a statement about the risks involved, such as the consequences of defaulting on payments.

- No misleading claims: Avoid making claims like “guaranteed approval” or “no credit check,” unless these are factual and verifiable aspects of the loan.

- Advertising standards: Align with the relevant advertising standards. Avoid aggressive marketing techniques that might put too much pressure on people to buy or sign up.

- Privacy compliance: Make sure data collection or sharing practices adhere to regulations like GDPR (for Europe) or similar laws in other regions.

Challenge 2 – Building a niche audience

Focusing on a niche audience is a necessary part of affiliate marketing. But how exactly do you do it?

Firstly, you need to find out about your target market’s specific financial interests and needs. Are they young professionals looking for investment advice? Maybe they’re older and planning for retirement. Parents seeking savings plans for their kids might be another good niche audience.

Once you’ve nailed down your audience, you need to create high-quality, useful content that speaks directly to them. Examples include blog posts with budgeting tips, podcasts on investment strategies, or webinars on how to manage household finances.

The goal is to become the go-to resource for your specific audience through the posting of consistently helpful content.

As well as blogs and YouTube videos, social media platforms such as LinkedIn, Twitter, or Instagram let you connect directly with your audience. You can share valuable insights, answer common questions, and engage in conversations. Native advertising platforms like Outbrain enable affiliate marketers to target relevant audiences with financial ads on news and entertainment websites. This is a great way to capture their attention while they browse their favorite sites and are open to discovering new products and services. Building exposure across a range of channels is the key to success.

Challenge 3 – Gaining trust

Gaining trust is tricky in any industry, but especially finance. People need to feel secure before signing up for a financial commitment. That’s why educational content works well in the finance sphere. Consumers prefer content creators who explain complex financial choices in simpler terms, making it much easier for them to make informed decisions.

The golden rule of financial affiliate marketing is – never mislead people.

Stay transparent by being upfront about your partnerships and providing honest and accurate information. Dishonesty will blow up in your face in terms of lost business, as well as potentially landing you in hot water with the law.

One way to build more trust is to include customer reviews and testimonials in your content. Other people’s stories add authenticity. Try to show how you or other people have benefited from the products, as this will encourage others to try them too.

If for whatever reason, you do get some negative feedback, make sure you address it openly. Show that you value feedback and remain committed to improving. Sometimes, the way you handle criticism can build more trust rather than deplete it.

Challenge 4 – Understanding new tech

In the fintech era, the market is flooded with innovative solutions, catering to all sorts of needs. There are opportunities to promote anything from simple budgeting apps to AI-driven investment tools.

To do this successfully, you need to understand the products and market demand. This means using them yourself, or at least taking the time to know the product inside-out and get insights from other customers about its strengths and weaknesses. Why?

The reason is that you should aim to create content that educates your audience as well as promoting the product. This makes conversions much more likely.

Financial Services Affiliate Marketing: How Does Payment Work?

Some financial affiliate programs are based on pay-per-click models, while others focus on conversions, such as approved applications or account openings. The payment structure often depends on the product type and the affiliate’s audience.

Cost-Per-Click (CPC)

CPC is pretty straightforward – you earn money every time someone clicks on your affiliate link. The aim is to get as many eyes on those ads as possible. This model is great for blogs or websites with high traffic.

Cost-Per-Acquisition (CPA)

With CPA, you earn a commission when the click leads to a specific action – like signing up for a credit card or opening a new bank account. The commission here can be lucrative, especially when promoting high-value financial products.

Cost-Per-Impression (CPM)

You’re paid based on the number of views an ad gets. This works well for sites with high traffic but not necessarily high engagement with specific ads.

Affiliate payment example:

According to research, the average Google Adsense CPC is around $0.15, which can fluctuate depending on site traffic and credibility factors. Let’s say a medium-sized blog manages a CPC of about $0.20. At this rate, they’d make $20 for every 100 clicks on the ads.

However, if this same blog focuses on a specific niche and achieves a 1.5% conversion rate after the click, the scenario changes significantly. With financial services often offering a cost-per-acquisition (CPA) of around $100, the same number of clicks could yield $150.

In other words, the blog has the potential to rake in more than seven times as much income through affiliate marketing compared to standard ad revenue.

Some of the top financial affiliate programs, offering the most generous deals are:

- Credit Karma affiliate program

- Coinbase affiliate program

- Credit Sesame affiliate program

- Robinhood affiliate program

- Personal Capital affiliate program

- Questrade affiliate program

Financial Affiliate Marketing: The Regulatory Landscape

Affiliates must ensure their marketing practices comply with industry regulations to avoid penalties. Penalties for non-compliance can be severe – from hefty fines to legal action and even a ban from affiliate marketing in the sector.

For this reason, financial service companies usually set out clear guidelines for their affiliate partners. This may include advice such as:

- precise language that should be used,

- the kind of disclosures required,

- and overall guidance on messaging and branding.

Financial companies often have dedicated teams in place that monitor compliance. They may also provide training and resources to affiliate marketers.

Laws such as GDPR in Europe or CCPA in California have changed how financial data is handled. Affiliates need to make sure they collect, store, and use consumer data in compliant ways.

Let’s take affiliate content for credit cards, for example. The content should clearly state any fees, interest rates, and offer details without making any misleading claims. It may also include a straightforward disclaimer about data usage and consumer rights under data protection laws or link to a privacy policy.

Staying up-to-date with ever-changing regulations is crucial for affiliate marketers in finance. You need to continually educate yourself and collaborate with clients to make sure you’re keeping things compliant. Many successful affiliates also attend industry conferences and webinars to keep their knowledge fresh.

Marketing compliance management software can also help track whether you’re staying compliant with regulatory standards. Some software alerts you if your content strays into non-compliant territory.

Affiliate Marketing of Financial Services: Success Stories

Targeted content creation is the most effective strategy for financial affiliate marketing success.

You need to tailor your content so that it catches the attention of your audience and speaks directly to them. Create content that resonates with their needs, addresses their challenges, and offers valuable advice and solutions.

Most successful affiliate marketers also run ads to drive traffic to their website or blog. Native advertising is great for reaching your audience and Outbrain’s native advertising leads the field.

Case in point: CheBanca! Strategy

For example, CheBanca! an Italian fintech company specializing in retail banking and mortgage lending teamed up with Outbrain. Using Outbrain’s programmatic ads, they accessed premium publishers and a unique inventory that was just right for their goals.

Outbrain’s High Viewability package ensured their ads appeared in spots with at least 70% viewability. This was helped by Outbrain’s Predicted Viewability, which uses machine learning to predict the viewability of each impression and bid only on those that meet CheBanca’s criteria.

The result?

In just a single month, CheBanca! saw a 17% improvement in viewability and a 40% CTR increase. That’s the power of smart, targeted advertising using a platform like Outbrain.

Case in point: Max Life Insurance Strategy

Another example is Max Life Insurance, a leading life insurance company in India, which was on a mission to enhance its marketing strategy by integrating native advertising. The company sought to tap into Outbrain’s advanced targeting capabilities to reach potential customers more effectively.

The results were impressive:

- 6X increase in quality leads, signifying a substantial boost in potential customers.

- 10% reduction in the cost per qualified lead, enhancing the cost-effectiveness of the campaign.

- 5X increase in quotes, indicating a heightened interest and engagement from potential customers.

It’s All About the Money

Affiliate marketing in the financial space presents the potential for high earnings, but also some challenges.

Financial affiliate marketers need to pay close attention to:

- Navigating a highly regulated business landscape

- Building trust with consumers

- Delivering targeted, useful content

- Using adtech to boost campaign efficiency

The main thing to remember is that success in finance affiliate marketing comes from creating meaningful connections between financial products and consumer needs. Outbrain’s native advertising platform is an effective way to bridge this gap. To find out more about Outbrain, get in touch today.