7 Tips to Shore Up Your Finance and Insurance Campaigns with Native Discovery

If the pandemic has reminded us of anything, it’s that change happens when we least expect it. In the blink of an eye, lives have been altered; travel plans have been put on hold; dreams and careers have hit pause; and social distancing is front and center under strict government guidelines. The pandemic has impacted people’s health and finances, and grown fears of a global economic downturn.

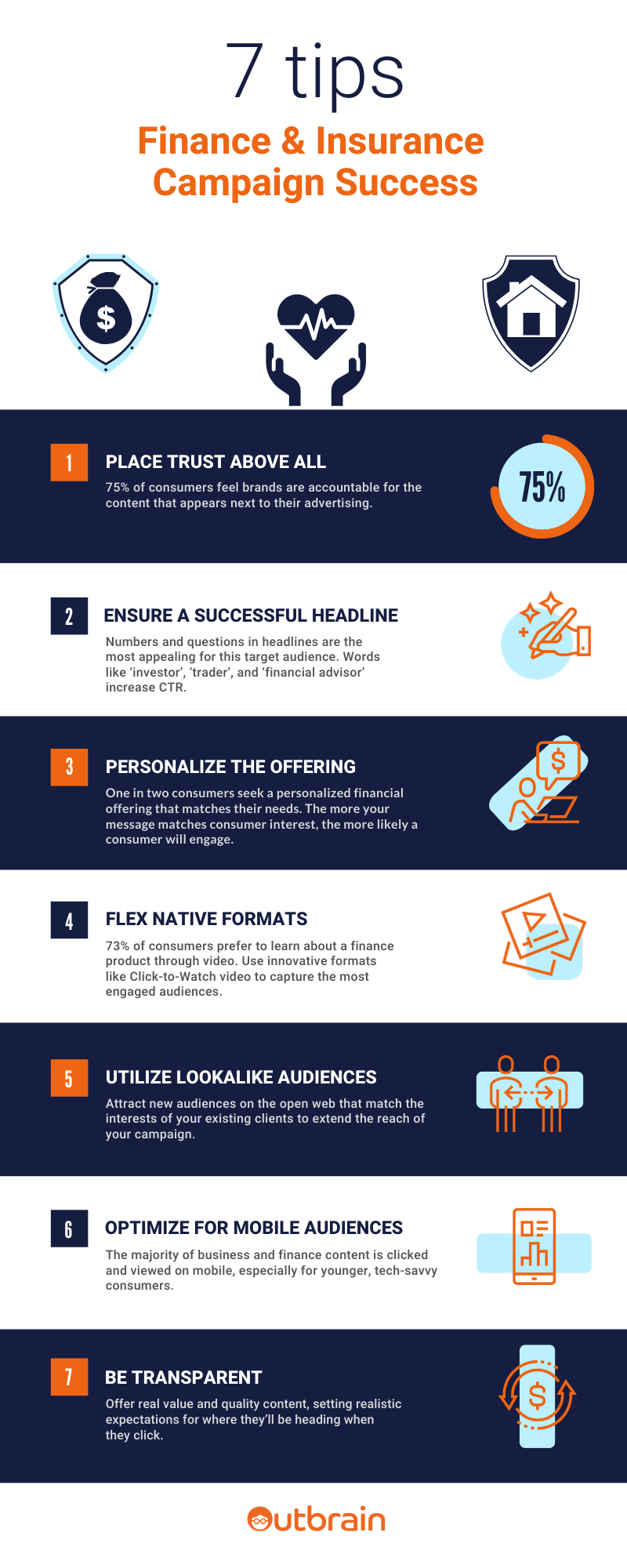

Prior to the crisis, finance brands were predicted to increase 2020 digital ad spend by 18%. While those figures will need to be reevaluated, brands should be playing an essential role in helping, educating and reassuring their customers.

Address the New Level of Disruption

As a society, we already live on the razor’s edge, and the impact of COVID-19 will put an impetus on risk mitigation now more than ever, and consumers will increasingly look for financial guidance and products to secure their hard-earned money.

In April, within the business and finance category on the Outbrain network, investment content had the lion’s share of page views but insurance and credit card content had the largest percentage growth in page views. Tracking consumer interest trends during and after the crisis will allow brands to be relevant and impactful.

Expand Relationships with Trust

In the wake of COVID-19, people are spending nearly 50% more time reading the news than checking social media.* More so now than ever, people are turning to publishers for trusted content.

Equally for advertisers, especially those of finance brands communicating sensitive and sometimes complex products and services, reaching their customers within trusted environments is imperative. A 2019 consumer study found that sponsored content on premium news sites is 44% more likely to be trusted than ads on social media platforms.

*Source: GlobalWebindex March 2020